tax strategies for high income earners 2021

Withdrawals are taxed at your ordinary income tax rate. For example lower earners pay no tax then the rate starts at 20 growing to 40 for higher rate taxpayers.

For each pound that a contractor earns over 150000 the marginal rate becomes 45 so higher earners pay more tax.

. For 2021 and 2022 you can contribute a maximum of 6000 to a traditional IRA those 50 or over can add an additional 1000. High earners also pay an additional 09 Medicare tax on income that exceeds a certain amount. Alternative minimum tax 2020-2021.

Traditional IRA Income Limits in 2021 and 2022. The AMT increases the amount of income that is taxed for high earners. More than a quarter of Canadians who make over 400000 a year paid less than 15 per cent in federal personal income taxes in 2019 according to the federal budget released on April 7.

Top 6 Strategies to Protect Your Income from Taxes. The difference between the federal tax and provincial tax. You can avail of the maximum BPA tax credit if your 2021 income is below 151978 and a minimum of 1863 if your income is above 216511.

Some high earners may simply prefer to wait and pay taxes on investment gains in. For the 2021 tax year single filers with three children can have incomes up to 51464 and receive the earned income tax credit while married couples with three children must earn less than. Congress raised taxes again in 1932 during the Great Depression from 25 percent to 63 percent on the top earners.

Thats a high tax rate. Now for high income earners. Support for 2021 taxes added 422021.

High-income individuals pay more in taxes as a percentage of their taxable incomes than low-income earners. What it is and who has to pay. The 29 tax we already discussed and an extra 09 tax on all income above a threshold.

In the UK when you look at income tax bands it appears that way. These are just some of the reasons that tax-exempt strategies. This account receives special tax treatments including the option to deduct contributions which are limited to 3600 for single filers and 7200 for families in 2021.

As we mentioned earlier war is expensive. Medicare can actually be thought of as 2 separate taxes. 10 12 22 24 32 35 and 37.

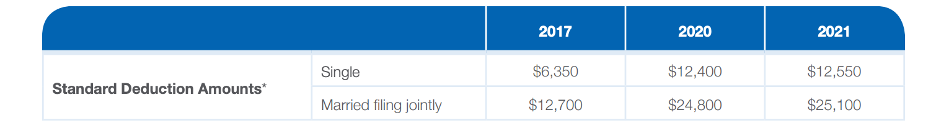

Your taxable income would be 72000 if youre a single filer with an income of 84550 and if you were to take the 2021 standard deduction of 12550. World War II. Calculate How Much You Owe and Explore Tax Saving.

2021 and 2022 Tax Brackets. However this is not the full story. Removed Below Line Self Employment Deduction 572021.

Your tax bracket depends on your taxable income and your filing status. Retirement withdrawal strategies. There are seven tax brackets for most ordinary income for the 2021 tax year.

After the war federal income tax rates took on the steam of the roaring 1920s dropping to 25 percent from 1925 through 1931.

Tax Strategies For High Income Earners Wiser Wealth Management

The Real Reason That You Live Paycheck To Paycheck Habits How To Make Dough Budgeting

The 4 Tax Strategies For High Income Earners You Should Bookmark

Amazon Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Mackwani Adil 9781734792621 Books

The Spanish Milled Dollar Was Declared Legal Tender In The United States In 1793 Silver Dollar Silver Dollar Coin Dollar

Backdoor Roth Ira Steps Roth Ira Ira Roth Ira Contributions

2021 Tax Changes Biden S High Income Families Income Capital Gains Taxes Proposal

Top 10 Pros And Cons Of Instagram Business Account Instagram Business Instagram Business Account Business Account

The 4 Tax Strategies For High Income Earners You Should Bookmark

How To Generate Passive Income Pay Little To No Tax Forever Passive Income Passive Income Ideas Social Media Income

Disability Loans Grants Low Income Finance Disability Grants Disability Low Income

The 4 Tax Strategies For High Income Earners You Should Bookmark

Irmaa 2021 High Income Retirees Avoid The Cliff Fiphysician Com Higher Income Income Paying Taxes

How To Set Up A Backdoor Roth Ira For High Income Earners An Immersive Guide By Justin Finance Real Estate