tucson sales tax rate 2019

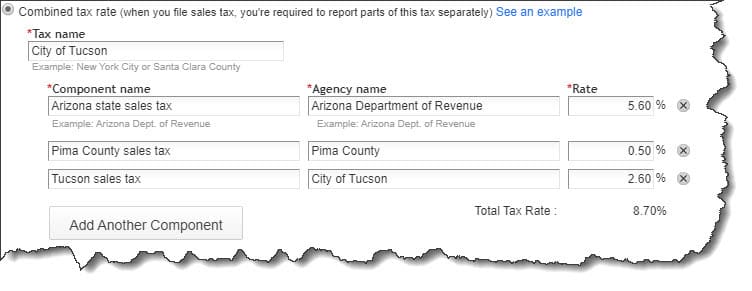

KOLD News 13 - The City of South Tucson city council narrowly approved a measure increasing the citys sales tax rate to 11 percent on Monday. The 87 sales tax rate in Tucson consists of 56 Puerto Rico state sales tax 05 Pima County sales tax and 26 Tucson tax.

On May 16 2017 Tucson resident voters approved a 5-year half-cent increase to the City of Tucson sales tax rate.

. Retail Sales 017 to. SOUTH TUCSON Ariz. 19-01 to increase the following tax rates.

Car sales tax rates are set by your state and unlike other parts of a new-car purchase they arent negotiable. Local General Sales Tax AZ State Sales Tax Apache Junction 400 560 Casa Grande 360 560 Florence 360 560 Maricopa 360 560 Queen Creek 295 560 Gila County Local General. TPT Tax Rate Table - November 2019.

The 87 sales tax rate in Tucson consists of 56 Arizona state sales tax 05 Pima County sales tax and 26 Tucson tax. TPT Tax Rate Table - October 2019. TPT Tax Rate Table - August 2019.

2019 Hyundai Tucson Preferred FWD Used for sale in Etobicoke at Hyundai from. The sales tax jurisdiction. There is no applicable special tax.

The City of Tucson tax rate increased effective July 1 2017 from 2 to 25 for most business activities and increased effective March 1 2018 from 25 to 26 for those. The minimum combined 2022 sales tax rate for Tucson Arizona is. The sales tax jurisdiction.

Arizona Sales Tax Rates By City County 2022 Sales Tax Rates In Tucson And Pima County Pima County Public Library 2021 2022 Sources Of Funds And Uses Of Tax Dollars Pima C. All regional property tax. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

The average tax rate on a home in pima county will be approximately 1 of market value. TPT Tax Rate Table - September 2019. There is no applicable special tax.

This is the total of state county and city sales tax rates. The Tucson Arizona sales tax is 860 consisting of 560 Arizona state sales tax and 300 Tucson local sales taxesThe local sales. Unlisted cities use county r ate for local sales tax The state sales tax rate in Arizona is 5600.

19-01 to increase the following tax rates. The current water rates and charges were adopted by the tucsons mayor and council on may 22 2018 and became effective july 1 2019. Download all Arizona sales tax rates by zip code.

The current total local sales tax rate in Tucson AZ is 8700. The December 2020 total local sales tax rate was also 8700. 2019 ARIZONA SALES TAX RATES as of 1212019 Cities iude the Countyncl Tax rate.

The car sales tax in your state is a percentage of the vehicles. TPT Tax Rate Table - December 2019. On July 15 2019 the Mayor and the Council of the City of South Tucson approved Ordinance No.

Effective July 1 2017 the rate will rise from 20 to 25. The City of South Tucson primary property tax rate for Fiscal Year 2017-2018 was adopted by Mayor Council at 02487 per hundred dollar valuation. The Arizona sales tax rate is currently.

The County sales tax. Retail Sales 017 to five percent 500. City of South Tucson.

Tucson Tax Rate Calculator.

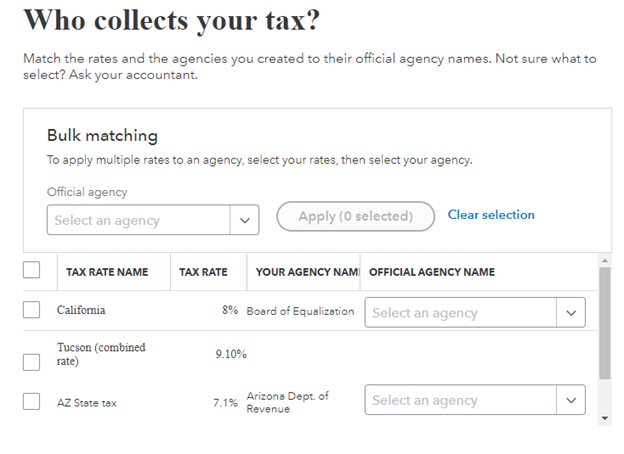

How To Process Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Property Taxes In Arizona Lexology

How To Process Sales Tax In Quickbooks Online

Arizona Sales Tax Rates By City County 2022

How To Record Use Tax In Quickbooks Online For Sales Tax Reporting Go Get Geek

Arizona State Taxes 2021 Income And Sales Tax Rates Bankrate

5 Things You Need To Know About Sales Tax In Quickbooks Online

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

State And Local Taxes In Arizona Lexology

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog

State And Local Taxes In Arizona Lexology

Import Transactions With Sales Tax For U S Quickbooks Online Companies Saasant Blog